Newsflash: The Stock Market Does Not Go Up in a Straight Line

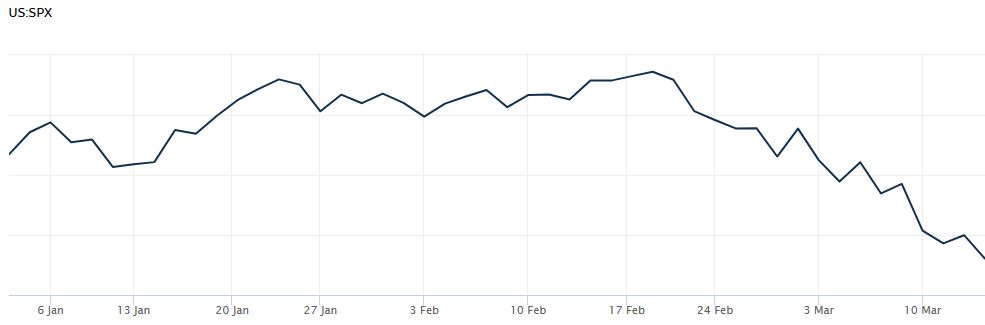

Submitted by Group W - Investment Management on April 2nd, 2025In the early weeks of 2025, equity markets continued the steady climb that had commenced two years ago, and the S&P 500 Index established an all-time high on February 19. Since then, however, stocks have declined steadily with the S&P 500 finishing the first quarter down 4.6 percent. Two factors seem to be contributing to the recent sell-off.

S&P 500 Index – Q1 2025 Source: WSJ

The first is a correction in the valuation of the high-flying information technology sector which accounts for almost a third of the S&P 500 Index. These stocks had been on a two-year run due to the hysteria over the development of artificial intelligence (AI) models which are touted to be the next big thing, comparable to the invention of the internet. These AI systems require an enormous investment in many data centers packed with high-end and expensive semiconductors. In recent weeks, though, some doubt has emerged about the level of investment required. Microsoft, for instance, recently announced a reduction in the amount they have budgeted for AI infrastructure. This cooling of interest in AI has resulted in lower and more reasonable valuations for the high-priced tech sector. The IT sector is down about 14% so far this year.

Second, economically sensitive sectors such as Consumer Discretionary and Industrial stocks have recently taken hits due to the uncertain outcome of the nascent trade war put forth by the current administration. Many corporate managers are stymied in their decision-making because they cannot estimate production costs with confidence. Consumers, as well, are showing signs of curbing their spending following the prosperous post-pandemic years. New tariffs are likely to make imported goods more expensive decreasing demand. Leaders at consumer-oriented companies such as Walmart and United Airlines have recently detected a slight slackening in sales. This implies the economy is slowing which is not constructive for the stock market in the short run.

In the meantime, safe and defensive assets such as consumer staples, utilities, bonds, and cash are the places to be until we get more clarity about where the economy is heading.

1 April 2025