IT is Driving the Train

Submitted by Group W - Investment Management on February 3rd, 2020Over the ten years since the global financial meltdown of 2008/2009, U.S. equity markets have been on a tear to the upside with just a few temporary setbacks here and there.

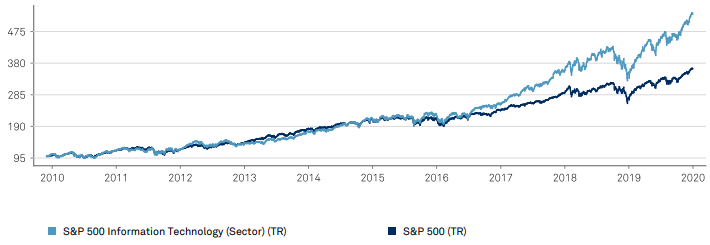

This is not news to anybody who is paying attention. What is remarkable, however, is how significant a role the information technology (IT) sector has played in the broad advance, especially over the last five years or so. (See chart.) Currently, the IT sector makes up about 23 percent of the S&P 500 Index.

Information Technology Sector vs. S&P 500 (Data rebased to 100 in 2010)

This is confirmation of the fact that IT (hardware and software) is steadily becoming the main engine of growth in our economy. Nowadays, there is hardly a single facet of our lives that is not touched by IT in some way. This is our future. The administration in Washington is fighting the good fight to bring old-line manufacturing jobs back to the U.S., which is a desirable thing. But a new dishwasher factory in Indiana is not going to move the needle. In a $20.6 trillion economy, it’s decimal dust. Information technology and its applications to other industries will drive GDP growth in America for many years to come. As an example, take Amazon. Though not really an IT company itself, Amazon has utilized information tech to completely upend almost every retail business in America. This is real impact.

As investors focused on the long term, it is important we have exposure to the information technology sector. Currently, about 25 percent of the equity portion of your account is invested in IT companies. Here is a brief rundown of the IT stocks owned by Group W clients:

Alphabet is the parent company of Google, a business that needs no introduction. Through its ubiquitous search engine and digital advertising services, virtually every person in the world is affected by Google in some way or another. Revenues have increased 20% per year over the last ten years. Though in the future Google may be subjected to regulatory constraints by various government entities, the company will continue to dominate new developments in mobile, public cloud, and big data analytics, as well as emerging areas such as artificial intelligence and virtual/augmented reality.

Arista Networks is a supplier of networking solutions to large internet companies, cloud service providers, and data centers. Sales have grown 30% annually over the past five years with profit margins exceeding 20%. The company is taking market share from industry behemoth Cisco.

Cabot Microelectronics is the leading supplier of polishing slurries used in the manufacture of semiconductors. Sales have grown 16% annually over the past five years.

Fiserv provides information management and e-commerce systems for the financial services industry. FISV has been a steady grower for many years, and with the recent $22 billion acquisition of First Data Corp, management expects to boost earnings by up to 40% after reaching full integration of the company.

Intel is a manufacturer of integrated circuits for personal computers, servers, and other electronic equipment. INTC operates in a high margin, though a competitive industry. Over the past 10 years, the company has returned 100% of free cash flow to shareholders in the form of dividends and stock buybacks.

Microsoft, the world’s largest software developer, has steadily diversified its offerings over the past decade. In addition to the flagship products, Windows and Office, other Microsoft products include Skype, Bing, MSN, Xbox game consoles, and Surface laptops. Its cloud computing platform, Azure, has a very strong position in that market and is growing very rapidly. The stock was up 57% in 2019.

Resonant is an early-stage company that designs filters for radio-frequency (RF) front-ends in mobile devices. An RF front-end is the circuitry that processes the signals that are received by a mobile device. With the coming rollout of 5G wireless technology and the associated proliferation of signal bands, filter requirements for mobile devices will increase dramatically. Resonant should benefit from the increase in demand for high capacity filters.

Skyworks Solutions develops and produces semiconductors used in mobile phones and other wirelessly connected devices. The company’s profit margins are high, and Apple is a major customer. SWKS should benefit from the coming rollout of 5G wireless technology.

1 January 2020 Group W Investment Management