Cross This Off Your Worry List: Bank Failures

Submitted by Group W - Investment Management on September 30th, 2022Investor sentiment is quite unsettled these days. Most market participants have memories of the Great Recession of 2007-2009, if not the economic malaise of the 1970s, and wonder if we are headed for a reprise of those dark days. It is a reasonable concern given all the unusual economic and geo-political events of recent times. Stubbornly high inflation, ongoing disorder in distribution systems, raw material shortages, microchip shortages, labor shortages, and soaring housing costs are just a few of the economic maladies that have surfaced in the wake of the Covid epidemic and the war in Ukraine. Adding to the uncertainty, we see politicians and central bankers pulling in opposite directions as they try to address the problems. Fiscal policymakers around the world are trying to stimulate economic activity with government programs and tax cuts (mainly to get reelected). While monetary policymakers are attempting to retard economic activity and quell inflation through higher interest rates. People are justified in their confusion over the economic future of our country and the world. There is plenty to be concerned about.

But here is some good news. There is one facet of our economic system that is safer and more robust than it was during the meltdown of 2007-2009: the banking system. This is one thing the politicians and regulators have gotten right. The Dodd-Frank Act, enacted in 2010, covers a lot of financial issues, but probably its most significant feature is tighter capital requirements for the major banks in our country. Remember “too big to fail”? Well, we still have about two dozen financial institutions that are too big to fail, but thanks to the new regulations, it is highly improbable any of them will go bankrupt. The regulations apply to commercial banks, investment banks, and mortgage lenders.

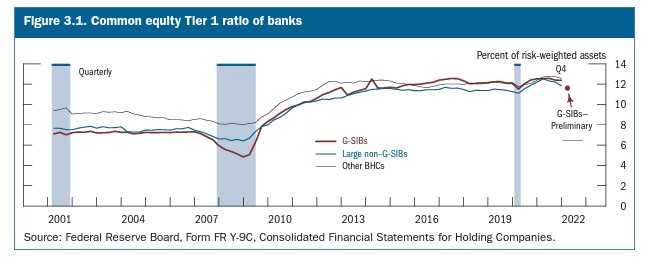

The graph below shows how the capital positions of banks operating in the U.S. are much improved over the pre-2007 period by a factor of almost 2X. This simply means they are not lending out as much of their capital as before and, therefore can better withstand defaults of borrowers. (G-SIBs = global systematically important banks)

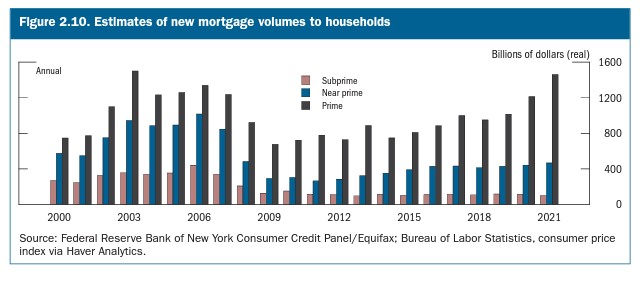

The second graph shows how the quality of loan portfolios at the big banks has improved as well. The amount of subprime and near-prime loans the banks are carrying is much reduced from the days before 2007.

Of course, this doesn’t necessarily mean everything is hunky-dory in the investing realm, but it is one less thing to worry about.

* * *

The U.S. stock market gave investors a head-fake during the third quarter. The summer started off with a strong rally lasting about six weeks. Market enthusiasm, however, eventually faded. The stock averages finished down about 4% for the quarter. Pessimism abounds.

However, there are faint signs that inflation may be abating. If that is the case, we can expect interest rates to stabilize which will make equities more attractive. Unemployment is still low, and the financial sector is strong. Astute investors are using this period to identify solid companies selling at attractive prices. This is not the time to bail out.

1 October 2022