Novel Recession

Submitted by Group W - Investment Management on April 7th, 2020For the equity markets, 2020 began with a continuation of the rousing gains that were posted in 2019. The economy was chugging along. Unemployment was low; wages and GDP were rising. By mid-February, the S&P 500 Index had reached an all-time high of 3386. The future looked bright. Ahh, the good old days.

Our current reality is a little different. Like something out of the Old Testament, a wave of pestilence has swept the globe. Posing a serious health crisis for the people of the world, the COVID-19 virus has forced authorities to shut down large parts of our society. The global economy has slowed dramatically, and stock markets have plummeted.

How long will the shutdown last? It is anybody’s guess. The experts’ predictions range from a few weeks to six months or more. What the economic landscape will look like after we slay the microbes is also unknowable, though our society is likely to be permanently changed in certain ways.

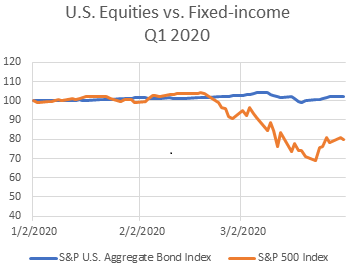

In addition to the health and safety aspects of the pandemic, investors are strongly focused on the preservation of their capital. Indeed, investment portfolios have taken huge hits. It should be noted, however, that the damage has been limited to the equity portion of investor accounts. Fixed-income assets, on the other hand, have fared quite well during the crisis.

It is for this very reason that we insist on allocating a portion of every account to fixed-income investments. Historically, the performance of fixed-income assets (bonds, notes, CDs, etc.) has been weakly correlated with the performance of equities (correlation coefficient: -0.3). The S&P U.S. Aggregate Bond Index, which represents a broad array of investment-grade bonds and notes, has performed well during the recent stock market sell-off with a positive return of 2.5% since the beginning of the year. (See chart below.)

Fixed-income assets are portfolio stabilizers. As the stock market struggles to find its footing during the economic downturn, which is just beginning, we can rest a little easier knowing that high-quality, low-risk fixed-income assets will dampen the gyrations of our investment accounts.

1 April 2020