2017 First Half Review and Outlook

Submitted by Group W - Investment Management on July 12th, 2017The first two quarters of 2017 proved to be profitable ones for investors. Over that period, the S&P 500 stock index appreciated 8.2% before dividends. The best performing sectors of the S&P 500 were its two largest: information technology and healthcare. Combined those sectors account for approximately 37% of the index.

In general, the prevailing economic winds have been favorable for stocks. Inflation and unemployment are low. Interest rates, though on a gradual upward trend, are still exceptionally low by historic standards. In Washington, the dysfunctional nonsense is a little disturbing, but any legislation that may actually get passed will likely benefit the overall economy and investors. (Regrettably; the ill, the indigent, and the environment may not fare as well.)

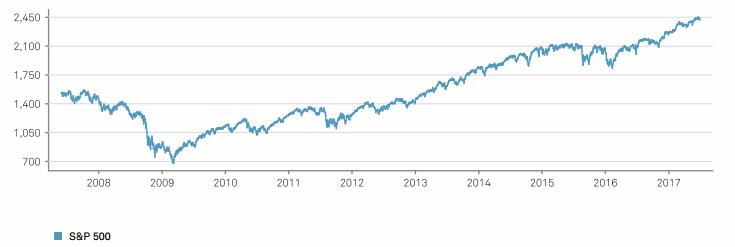

These circumstances combined with enhanced regulation of the financial system have provided excellent conditions for economic growth. However, as you can see from the chart below, the S&P 500 Stock Index has risen dramatically since the beginning of 2016 capping a secular bull run that began in the spring of 2009.

Equity valuations are at the high end of historical levels. Currently the S&P 500 Index sells at about 19 times projected earnings for 2017. The historic norm is around 16.

Has the market already priced in all of the potential growth in the economy? That appears to be the case, and it may take a while for corporate earnings to catch up with current expectations. There is a decent probability of a market correction in the near-term.

In light of this, Group W is maintaining a larger than usual position of cash and short-term debt instruments to be redeployed in the future as better stock prices become available.

Frederick Maxted - Group W Investment Management LLC 1 July 2017